Condo Insurance in and around Baton Rouge

Looking for outstanding condo unitowners insurance in Baton Rouge?

Cover your home, wisely

Welcome Home, Condo Owners

Often, your home is where you are most able to catch your breath and enjoy the ones you love. That's one reason why your condo means so much to you.

Looking for outstanding condo unitowners insurance in Baton Rouge?

Cover your home, wisely

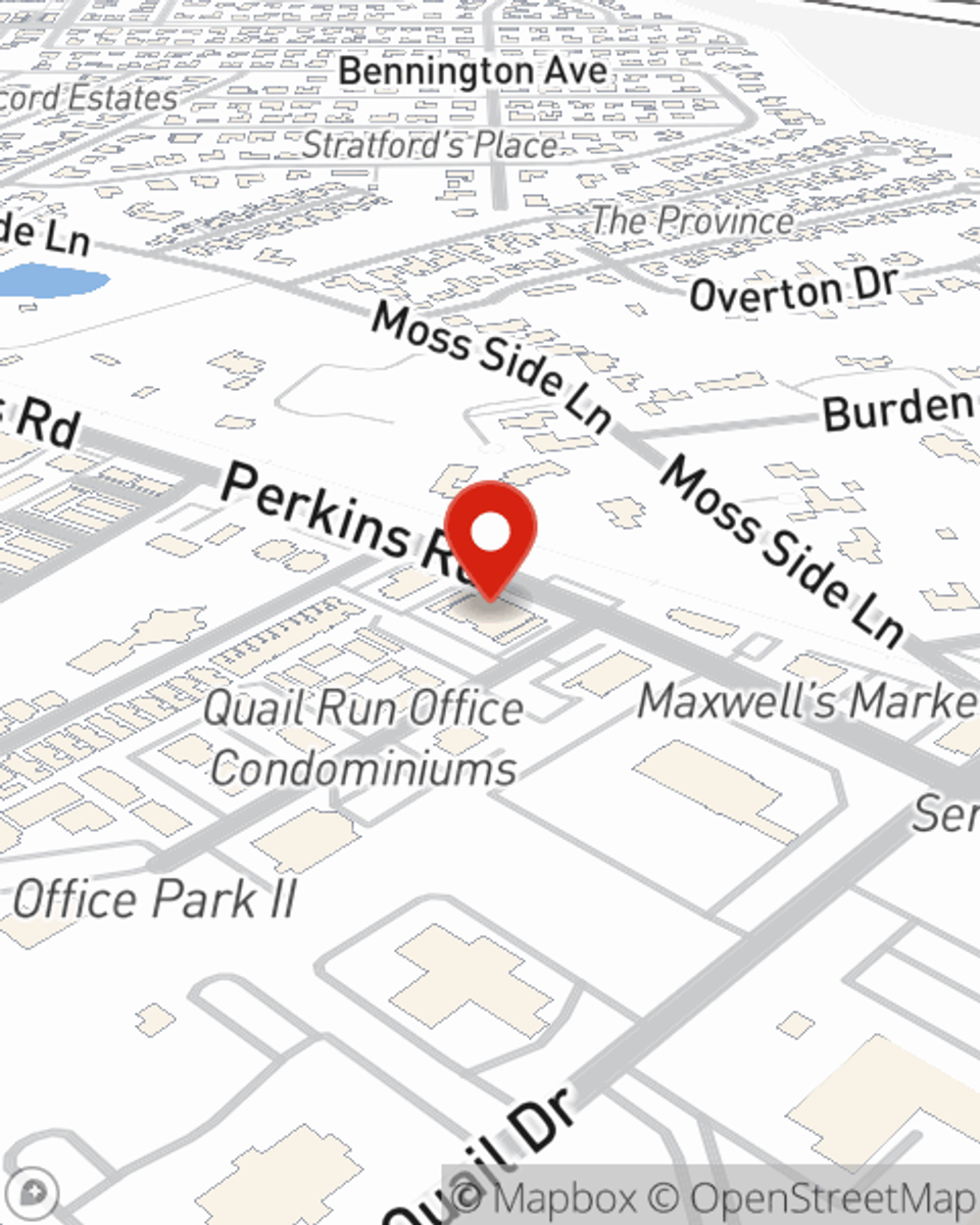

Agent Steven Brooksher Jr., At Your Service

We know how you feel. That's why State Farm offers excellent Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Steven Brooksher Jr. is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that works for you.

Don’t let the unexpected about your condo stress you out! Reach out to State Farm Agent Steven Brooksher Jr. today and find out how you can meet your needs with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Steven at (225) 769-9955 or visit our FAQ page.

Simple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Steven Brooksher Jr.

State Farm® Insurance AgentSimple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.